The Ultimate Guide to WooCommerce Payment Gateways

You just put the finishing touches on your new WooCommerce store. The design is beautiful, the UX is smooth and the products are all loaded in, ready to go. But have you put any thought into arguably the most important element: Which WooCommerce payment gateways to implement?

The main goal of any WooCommerce store is to generate sales and bring in money. And therefore, that last stage of the customer purchasing journey - when they actually punch in their credit card details - is arguably the most important step. If a customer arrives at your checkout but doesn’t complete the WooCommerce order form, then all that time, money and effort spent on all the other elements of your website were for nothing.

Fortunately, payment gateway options have dramatically evolved and improved as we have moved into the modern era of web browsing. Gone are the days of clunky payment gateways that were near impossible to securely implement from the seller's side, and looked untrustworthy from the buyer’s side. Today we are going to lend you a helping hand and breakdown what we think are the best payment gateways for your WooCommerce store.

What is a payment gateway?

To ensure everyone is on the same page, let’s quickly go over what a payment gateway actually is. A payment gateway is a software application that payment service providers use to process payments for online purchases on a merchant's website (the seller). In simple terms, it allows your customers to enter their payment details (ie: credit card number) and pay for items on your eCommerce store. Good payment gateways should be fast, easy to integrate, affordable, and of course, use the latest encryption technology to ensure your customers’ data is secure throughout the entire payment journey.

Within the world of WordPress and WooCommerce, payment gateway software is implemented through WordPress plugins.

Key factors to consider when evaluating WooCommerce payment gateways

We checked out the WooCommerce payment gateways page for some guidance on this question. And while there are many factors you need to consider, WooCommerce boiled it down to 4 main ones:

Cost

Startup and ongoing costs are different for each payment gateway. You will need to consider:

Is there an initial cost of purchasing the gateway? Some will have a cost, while others are free.

Is there a sign-up fee charged by the payment gateway?

Are there any yearly subscription fees?

How much are the transaction fees? Many will be at a min flat rate + an additional percentage.

Location

Many payment gateways only support certain countries and currencies. For example, if a payment gateway only accepts US dollars, but you want to trade in another currency, you won't be able to use it.

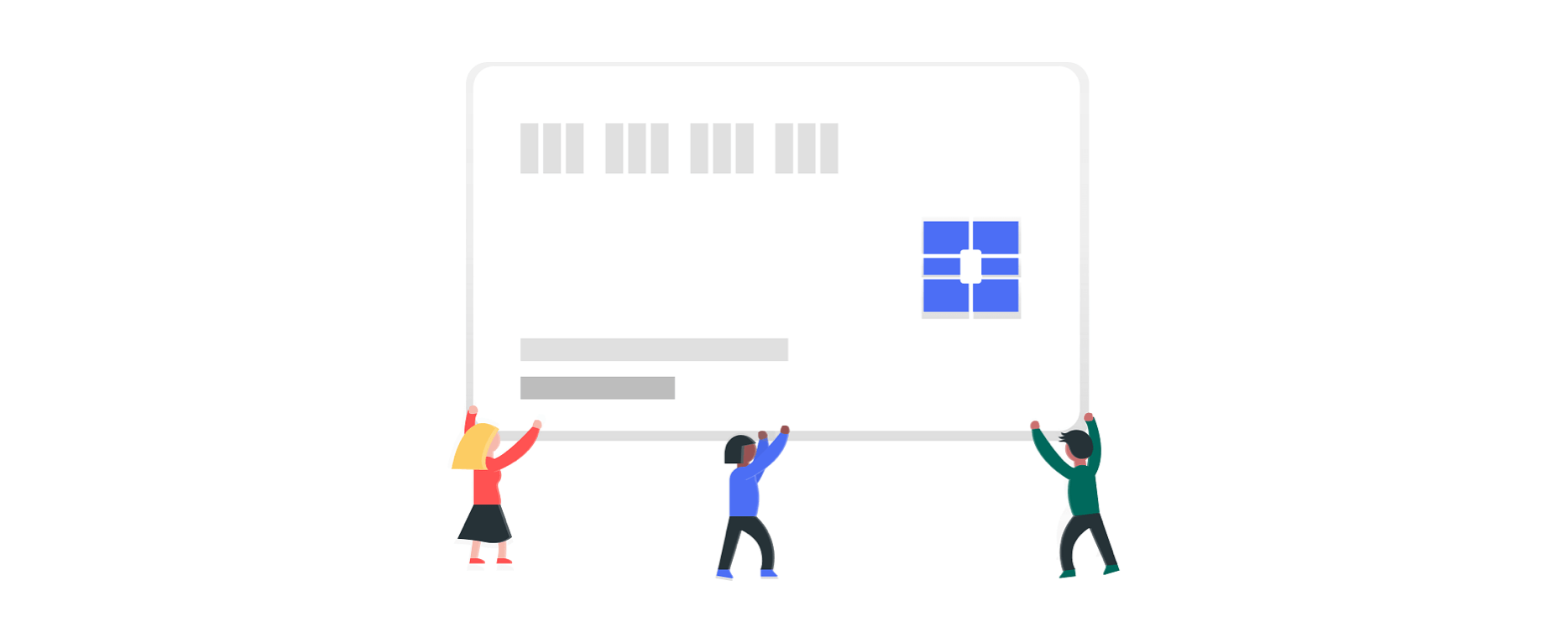

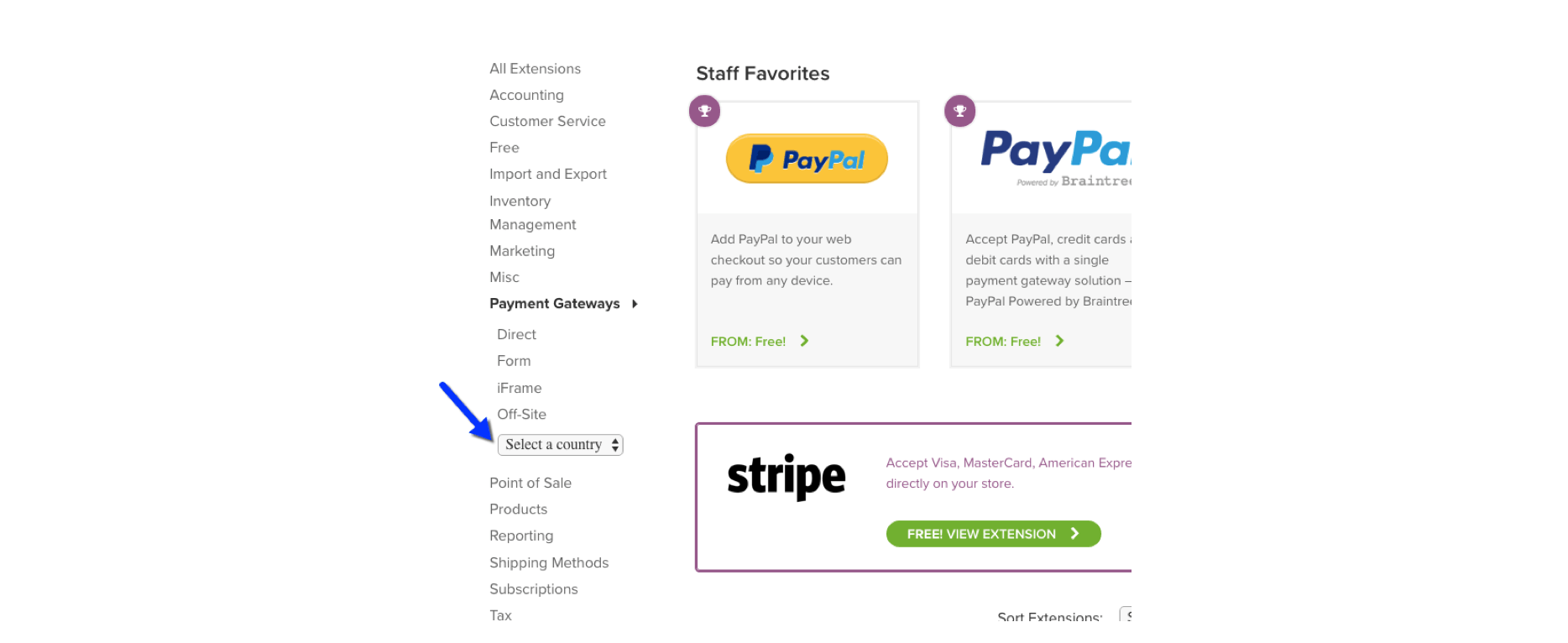

WooCommerce provides a country filter in the extensions store so that you can check which payment gateways work in your country:

Security

Customers generally won’t purchase from you if there is a chance that your eCommerce store isn’t secure. That’s why most payment gateways require you to have an SSL (secure socket layer) certificate. This ensures that all communications between your site and customers are encrypted and secure. When a website has the green padlock, this means it has an SSL certificate:

The majority of the gateways we are going to look at today will require you to have an SSL certificate. Check out Let’s Encrypt to set one up for free, or chat with your host and see what they can do.

Additionally, you should also make sure your site is covered by the Payment Card Industry Data Security Standard (PCI-DSS).

Support for subscriptions

If you are planning to sell a subscription product or service (like a monthly subscription box), make sure the payment gateway you choose supports WooCommerce Subscriptions.

WooCommerce Payment Gateway Breakdown

So now with the formalities out of the way, let’s jump into the main event.

Keep in mind: Any fees and costs listed below are current as of July 2019.

WooCommerce Payment Gateway - Stripe

.png)

.png)

Stripe has taken the eCommerce world by storm. With over 1,000,000 businesses already using it, including Amazon, Xero and Slack (and even Metorik!), it is quickly becoming the first choice for many merchants. Stripe prides itself on being affordable, simple to set up, and easy to use for both the merchant and its customers.

Price

Stripe has no initial cost or setup fee and takes a simple approach, charging a flat rate + a low flat fee per successful charge. This varies per country, but for example in the USA this 3.4% + $0.50, and in Australia this is 1.75% + $0.50 for domestic cards or 2.9% + $0.30 for international cards.

Features

Allows you to accept payments directly on your store for web and mobile.

Customers stay on your store during checkout instead of being redirected to an externally hosted checkout page. This has been proven to lead to higher conversion rates.

PCI-DSS compliant.

Optimized for mobile and fast checkout with Apple Pay and Google Pay.

Easily capture authorizations and process refunds from your WooCommerce Dashboard.

Support recurring payments with various payment methods via WooCommerce Subscriptions.

Multi-currency support.

Offered in 34+ countries.

Limitations

While you can charge in multiple currencies, these are automatically converted to your local currency. This is a big drawback for businesses wanting to hold multiple currencies and convert them at a later date.

WooCommerce Payment Gateway - PayPal

PayPal has been fundamental in paving the way for many other payments gateways. A household name in the PSP (payment service provider) industry, PayPal has helped millions of people pay for that product they purchased on eBay that they definitely didn’t need.

PayPal’s longevity has meant it is able to provide a smooth user experience, integrate into many platforms and work in many countries.

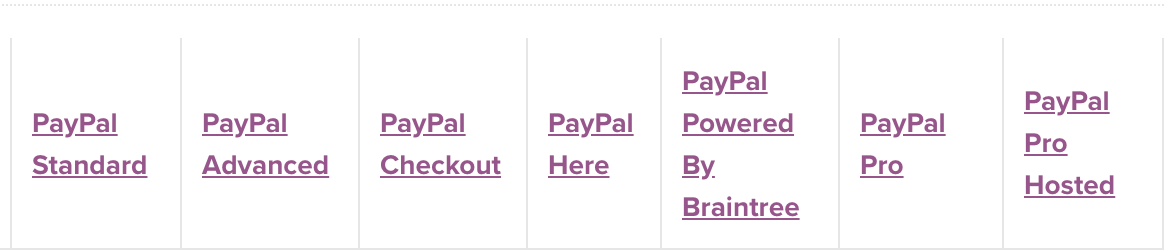

PayPal currently has 7 different plugins available on WooCommerce (a bit of overkill, we know). For the sake of simplicity and time, we will be breaking down the 2 mains ones, Payal Pro and PayPal Standard.

PayPal Pro

Price

Paypal Pro has an initial price of $79 to download the plugin, which also gives you 1 year of support and updates. It is also only available to holders of a PayPal Pro Business account which costs $30 per month. Then each transaction is charged at 2.9% + $0.30. The high set up and ongoing costs could be a deal-breaker for many smaller eCommerce stores without a lot of revenue.

Features

Allows you to accept payments directly on your store for web and mobile.

Customers stay on your store during checkout instead of being redirected to an externally hosted checkout page.

Multi-currency support.

PCI compliance.

Paypal fraud detection.

Limitations

Only available in the U.S, the UK, Canada and Australia.

Expensive.

Not compatible with WooCommerce Subscriptions.

We would recommend checking out PayPal Powered By Braintree as an alternative to PayPal Pro as it’s free to install and supports WooCommerce Subscriptions.

PayPal Standard

Price

PayPal Standard is a more affordable solution with no initial set up costs, only transaction costs of 2.9% + $0.30 per transaction (this varies per country). It also comes built-in with WooCommerce, so there is no need to install an additional plugin.

Features

Available in 200+ countries, making it a very accessible solution for business in smaller countries.

Affordable.

Takes customers from your site to PayPal’s secure site to finish paying for their order - which means PayPal ensures the transaction is 100% secure.

Multi-currency support.

Supports WooCommerce Subscriptions.

Paypal fraud detection.

Limitations

Takes customers from your site to PayPal’s secure site to finish paying for their order. This is also a limitation, as it could impact the flow of the customer purchasing experience.

WooCommerce Payment Gateway - Square

You have most likely seen Square’s credit card readers and POS systems when you have been out at a shop blowing your most recent paycheck on a new gadget or the latest pair of Yeezys.

Square has made a real impact on both the traditional business and eCommerce industries, boasting an impressive range of POS systems that integrate with an app to provide you with real-time analytics. Square also has a WooCommerce plugin so that you can take credit card payments on your online store and feed them directly into your existing Square account.

If you sell products or services in a physical store in addition to your eCommerce store, Square could be a great option as you can integrate your physical and online sales into one central hub.

Price

Similar to Stripe’s pricing system, Square has no setup costs and charges on an individual transaction basis:

Online transactions are charged at 2.9% + $0.30 (2.5% for UK, 2.2% for AU, and 3.6% for JP) for online transactions.

In-person transactions are charged at 2.75% (2.65% for CA, 1.75% for UK, 1.9% for AU, and 3.25% for JP)

Features

Sync products from WooCommerce to Square, or from Square to WooCommerce. When an item is purchased your inventory will automatically sync from Square to WooCommerce.

Allows you to accept payments directly on your store for web and mobile.

Customers stay on your store during checkout instead of being redirected to an externally hosted checkout page.

PCI-DSS compliant

Chargeback protection and fraud detection.

Limitations

Only available in the U.S, Canada, Australia, Japan and the UK.

No out of the box integration with WooCommerce Subscriptions - you may need to purchase an additional plugin.

At the time of writing, the plugin has some reviews listing issues with the inventory syncing.

WooCommerce Payment Gateway - Amazon Pay

Yep, that’s right, Amazon is also in the payment gateway game. Amazon Pay leverages the millions of already existing Amazon accounts, to provide a quick and seamless purchasing experience on your store.

After installing the Amazon Pay plugin on your WooCommerce store, your customers will be able to checkout using the existing Amazon account, and use their account’s billing and shipping details. No need for them to create an account on your store, or check out as a guest.

Having a known brand like Amazon in your checkout will also have the added benefit of making your customers feel more secure in providing you with their payment details.

Price

Amazon Pay also has no setup costs and charges 2.9% + $0.30 per transaction.

Features

Allows you to accept payments directly on your store for web and mobile.

Customers stay on your store during checkout instead of being redirected to an externally hosted checkout page.

Amazon-proven fraud protection and detection technology.

Mobile-optimized widgets for tablets and smartphones.

Multi-currency support.

Supports WooCommerce Subscriptions.

Limitations

Only available in 17 countries.

While you can charge in multiple currencies, these are automatically converted to your local currency. This is a big drawback for businesses wanting to hold multiple currencies and convert them at a later date.

WooCommerce Payment Gateway - Mollie

Mollie is a popular pick from the Woocommerce payment gateways list, specifically in Europe. It boasts support for over 20 different payment services, including many different credit cards, banks, Europoan and local payment methods, Apple Pay and even PayPal.

Mollie’s WooCommerce plugin allows your customers to easily see all the payment options available. And similarly to PayPal standard, the actual payment is done on Mollie’s site, so they have the security side taken care of.

Price

Mollie has no startup or ongoing fees. Transaction fees range depending on the payment method, but Mastercard and Visa transactions are going to cost you 1.8% + €0.25.

Features

Takes customers from your site to Mollie’s secure site to finish paying for their order.

Supports WooCommerce Subscriptions.

Edit the order, title and description of every payment method in WooCommerce checkout.

Support for full and partial payment refunds.

Multiple translations: English, Dutch, German and French.

Multi-currency support.

Limitations

Takes customers from your site to Mollie’s secure site to finish paying for their order. This is also a limitation, as it could impact the flow of the customer purchasing experience.

While you can charge in multiple currencies, these are automatically converted to your local currency. This is a big drawback for businesses wanting to hold multiple currencies, and convert them at a later date.

Conclusion 1.0

Similar to most things in eCommerce (and life as a matter of fact) there is no one solution that fits all when it comes to choosing a WooCommerce payment gateway. Your type of business and budget will dictate which will work best for you. We have however come up with a few recommendations depending on your store:

.png)

.png)

The start-up without a lot of money, that needs to get up and running quickly.

Our choice: Stripe

Stripe’s $0 set up costs, ease of setup, multi-currency support and availability in 34 countries makes this a no brainer for us.

The business that has a physical store and is looking to expand online.

Our choice: Square

Square’s integration between its physical POS systems, its online dashboard, and its WooCommerce plugin makes it a sound choice. The KISS (keep it simple stupid) principle really applies here… the simpler your system is, the more efficient, productive and profitable your business is going to be. That means, having one system that manages all your sales, both retail and online, is going to be better than having many different systems working separately.

The business that needs to sell in multiple currencies.

Our choice: PayPal Standard

If you want to accept multiple currencies and not have them all converted into your local currency automatically, then PayPal standard is your best option. It’s also available in 200+ countries, which is an added bonus.

The business that operates in Europe, or has many European customers.

Our choice: Mollie

Mollie’s extensive support for many European credit and debit cards, banks and other payment services makes it the best choice for European businesses, or businesses with many European customers.

Conclusion 2.0 (this is the last one, we promise!)

Most businesses aren’t going to fit exactly into one of these 4 categories we just described. And that’s no problem for Woo, as it actually allows you to have multiple payment gateways. Therefore you could set up a checkout with Stripe, Paypal, and even Amazon Pay, and let you customers choose whichever option they prefer.

Ultimately, all the WooCommerce payment gateways we have listed will allow your customers to pay you quickly and securely. We just recommend taking the time to choose the right one/combination that best suits your needs!